I’ve added new terms to the list of Business Vocabulary.

Don’t forget, the Chinese translations come from the Chinese students rather than professional translators. While I believe they are accurate, you may want to consult professionals before using them for official documents. This is mainly intended to contribute to daily conversation between English speaking Companies and Chinese companies.

Abbreviations:

v. = Verb

n. = Noun

adj. = Adjective

adv. = Adverb

(c) All Rights Reserved. You are welcome to use this material. However, if you do end up using these definitions in your material (educational, informational, or professional), please include either a link to this webpage or the following reference: Blessing, Olivia. “Business Vocabulary with Chinese Translations.” DeceptivelyBlonde.com. This is for two reasons: 1) I’d like to share the resource with others. 2) I created these definitions myself. Thanks!

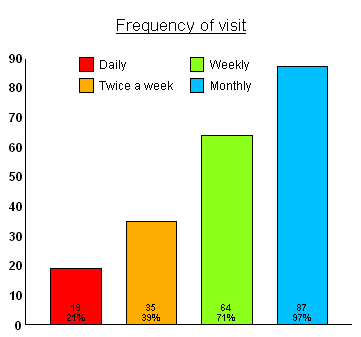

Bar Chart (n.) A way of showing information on a chart 图表. The chart shows the information divided up into rectangles. Each rectangle represents one factor and shows the “amount” of that factor. Allows readers to compare and contrast different things. 条形图 – Tiáo xíng tú

Capital (n.) ~ Wealth (usually money, but also includes other assets) used to buy the inputs and materials used in order to create products. The term has different meanings depending on whether you are an accountant, economist, or financial adviser. 资本 – zī běn

Graph (n.) ~ A way of showing the relationship between two factors in a picture or image form. Two lines, one called “X” and one called “Y,” are each used to represent one factor. Lines can then be drawn to show the relationship between X and Y as they change. 曲线图 – qū xiàn tú

Input (n.) ~ Resources used to create a product . . . technology, labor, raw materials, etc. Only materials used to make the product, not those used to sell, ship, etc. 用于创建产品的资源

Labor (n.) ~ 1. Effort. The work you put into something (“Thomas wants a higher salary for his labor“). 劳动 – Láodòng 劳动是人类生产力为改变商品的使用价值和增加商品的价值的实际使用 2. (In Economics & Finance) The number of employees (“When Capital is $15, the Labor is 4 employees“). Usually abbreviated 简短的 “L” in mathematical formulas and economic models. 劳动力 – Láodònglì

Labor (v.) ~ To work. To put effort into something. 劳动 – Láodòng

Loan (n.) ~ Money that A borrows from B and must eventually pay back. Often includes an extra “interest”息 fee. 贷 – Dài

Marginal (adj.) ~ In Business & Economics – A factor of or something that results from small or little changes. Often the profit, cost, or revenue associated with having or making “one more” of something. 边际 – biān jì

Marginal Cost (n.) ~ The cost that comes when you make one more product. 边际成本 – biān jì chéng běn

Marginal Profit (n.) ~ The profit (revenue – cost) that comes when you make one more product. 边际利润 – Biān jì lì rùn

Marginal Revenue (n.) ~ The revenue that comes when you make one more product. 边际报酬 – biān jì bào chóu

Negative Correlation (n.) The situation when two things (X & Y) are related to one another so that if X increases, Y decreases. If X decreases, Y increases. (X & Y go in opposite directions). In economics, we often say two things are “inversely related” if there is a negative correlation. For example, if Price goes up then Quantity Demanded will go down. There is a negative correlation and they are inversely related. 负相关 –– Fù xiāngguān

Output (n.) ~ The number of products created. 产量 – Chǎnliàng

Pie Chart (n.) ~ A way of showing information on a chart 图表. The chart is a circle divided into pieces, each representing a percent (%) of the whole “pie.“ 饼形图 – Bǐng xíng tú

Positive Correlation (n.) ~ The situation when two things (X & Y) are related to one another so that if X increases, Y also increases. If X decreases, Y also decreases. 正相关 – Zhèng xiāngguān

Quantity (n.) ~ The specific amount of something. Answers the question: “How Much.” 空头 – Kōng tóu.

Rate (n.) ~ 1. The speed at which something happens. For example the “Turnover Rate” 周转率 can tell us how often employees leave a company and new ones have to be hired. 率 – lǜ 2. The percentage of X compared to Y. For example, the “Tax Rate” is how much of the Revenue (Y) is used for Taxes (X). 比率 – bǐ lǜ

Scatter Plot (n.) A way of showing information on a chart or graph. A “Scatter Plot” is a graph where the information does not make a straight line 直线. Instead it is “scattered” (疏散) around the graph. 散点图 – Sàn diǎn tú

Short Sell (v.) ~ X borrows stock from a stock broker, sells the stock, buys it back, and then returns the stock to the stock broker. 卖空 – Mài kōng

Stockbroker (n.) ~ Someone who buys and sells stocks (a middleman – 中间人). 证券经纪人 – Zhèngquàn jīngjì rén

Stock Market (n.) ~ A place (either a physical market or an online market) where buyers and sellers trade in company shares. 股市 – Gǔ shì

Stock Price (n.) ~ The cost of purchasing one share (股) of a company. 股价 – Gǔjià

Substitution (v.) ~ Using one thing instead of another. Replacing X with Y. 取代 – Qǔdài